The American CBD industry is in full swing. With more than 14% of Americans using CBD products¹ and the hemp market swelling to $24.5 billion per year², hemp has become a force to be reckoned with.

A disproportionate number of CBD sales occur online, however, with far fewer Americans buying this cannabinoid from brick-and-mortar retailers. What’s the basis behind this trend, and what does it mean for CBD brands that want to succeed in today’s rapidly shifting environment?

In this guide, we’ll use the latest data to explain why US consumers choose to buy CBD online and lay out a path to success for operators in the American hemp space. Discover the factors driving online hemp sales and what they mean for the future of the CBD market.

Current status of the US CBD market

American CBD remains largely in the same strange place that the 2018 Farm Bill left it. This landmark piece of hemp legislation firmly separated CBD from THC and put the cannabinoid in the FDA’s court. Citing long-standing industry precedent and a continuing lack of clinical safety information, though, the FDA has been reluctant to fully legitimize CBD sales in the United States.

In 2017, the FDA approved Epidiolex as a prescription drug. Once the FDA has approved a substance as a prescription drug, it doesn’t generally approve the same substance for over-the-counter use. While Epidiolex generates a genuine conflict for the FDA, it’s also possible the federal agency is dragging its heels in anticipation of the improved clarity that would accompany successful federal cannabis reform legislation.

What do US consumers use CBD for?

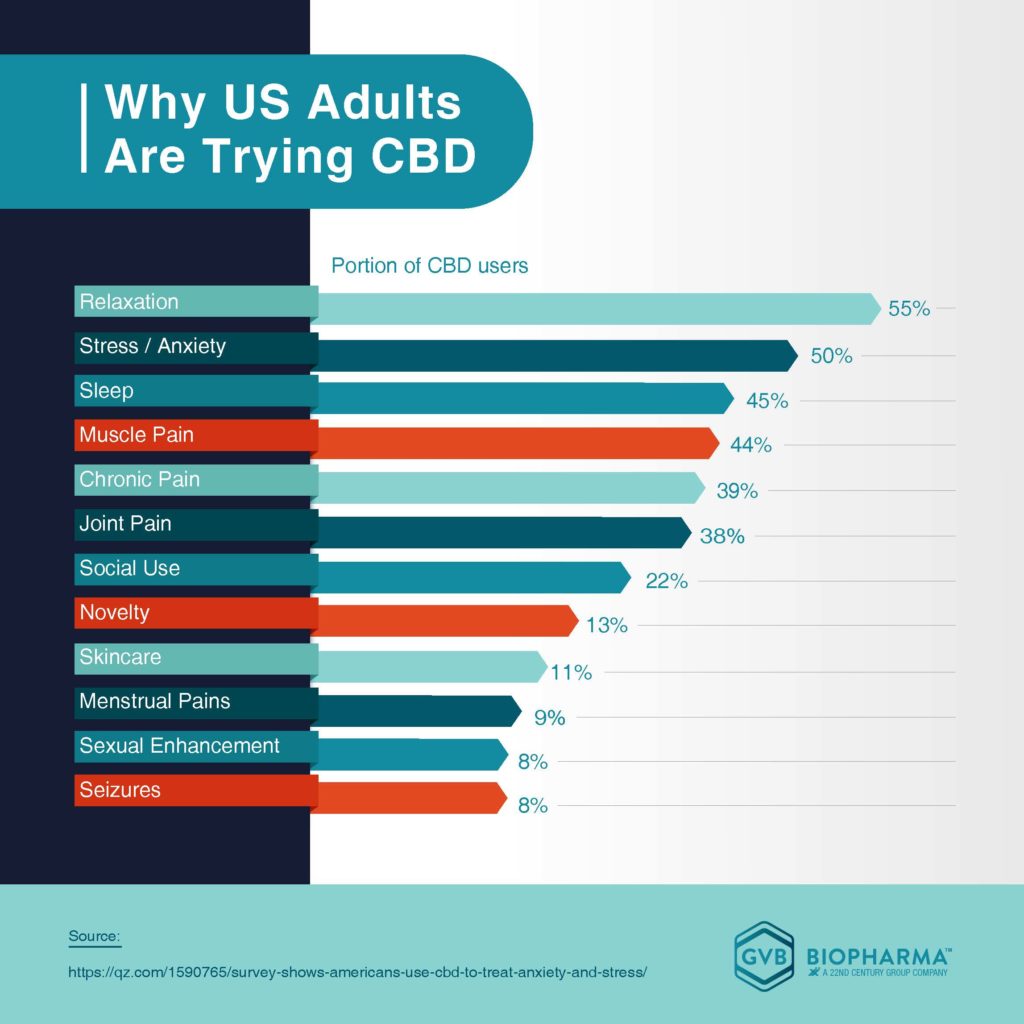

American consumers don’t seem to be particularly perturbed by the FDA’s lack of comprehensive CBD guidance. They continue to use this non-intoxicating cannabinoid in record numbers, and they’re increasingly turning to CBD for help with issues aside from pain and inflammation.

A 2019 Quartz survey⁴, for instance, found that 55% of Americans who had used CBD had tried it for general relaxation, and a further 50% had used it for stress or anxiety. Forty-five percent of US CBD consumers had used the cannabinoid for sleep with only 39% relying on it for pain.

This information clearly indicates that CBD is reaching a much wider audience than before. Average Americans — not just those suffering from pain — are discovering the many ways CBD can benefit their lives, driving sales of this cannabinoid ever higher.

Where do American consumers buy CBD?

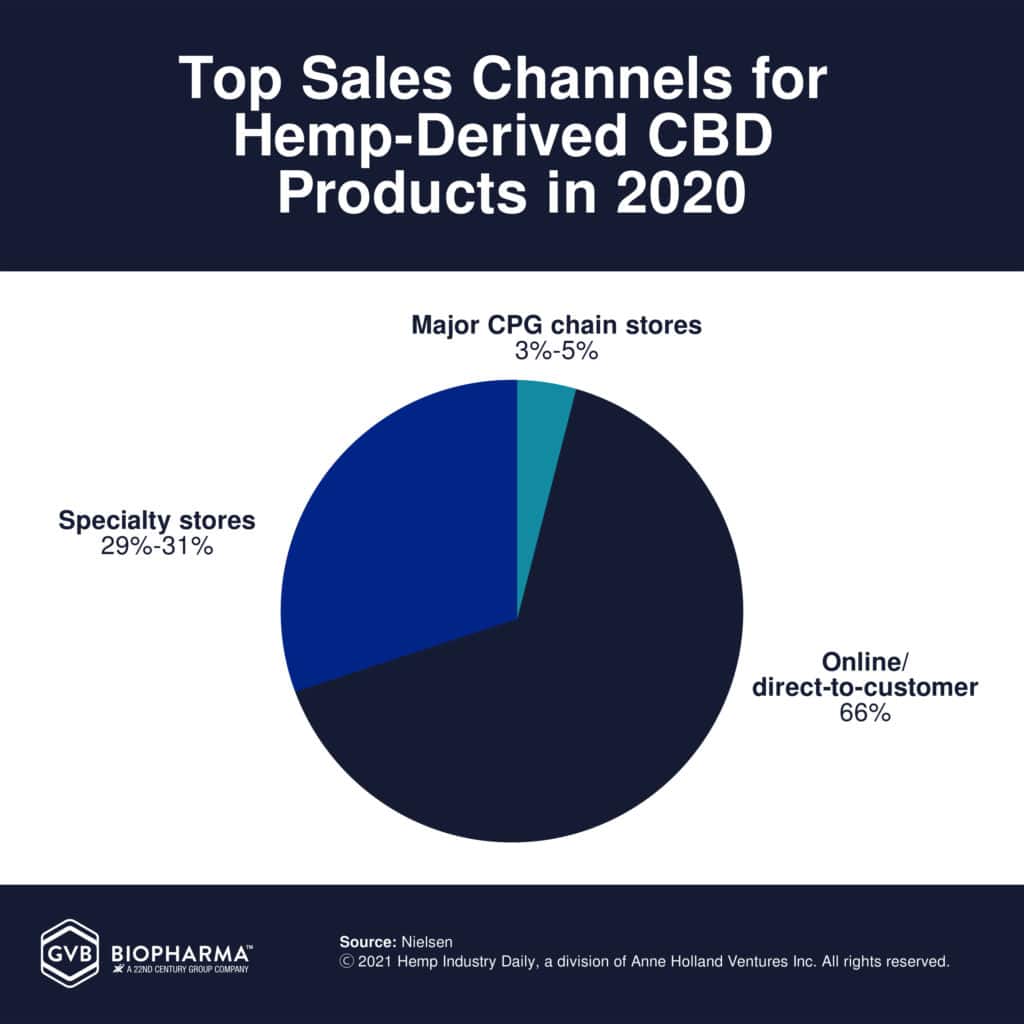

A 2021 Nielsen survey⁵ shed light on American CBD buying behavior by showing where US consumers are now purchasing their hemp products. Unsurprisingly, the vast majority of American hemp users buy CBD online, an existing trend that the pandemic significantly exacerbated.

Why do so many Americans buy CBD on the internet, and where else do they buy this cannabinoid? Let’s take a look:

1. Online

How many Americans buy CBD online?

According to the Nielsen survey, 66% of Americans now buy CBD online. The internet has always been the primary marketplace for hemp products, but 2/3 of hemp sales being conducted online is an unprecedented portion.

Why do Americans buy CBD online?

As with all other types of products, buying CBD online is easy and convenient. Some states still have laws restricting sales of certain kinds of CBD products, often making the type of CBD consumers want only available online.

During the pandemic, many of the smaller stores that traditionally carried CBD shut down or vastly curtailed their business activities. As a result, many consumers who had previously preferred to buy CBD in person were forced to start purchasing products online. Now, many of them haven’t elected to go back.

The Future of US Online CBD sales

Expect online CBD sales to take up an ever-greater share of the market over the coming years. Buying products online only gets easier as time goes by, and as more consumers enter the hemp market, their overall predisposition towards Ecommerce will skew CBD sales even further toward online channels. Barring some massive disruption of domestic shipping services, CBD sales are highly likely to continue to gravitate toward online ecosystems.

2. Specialty stores

How many Americans buy CBD at specialty stores?

Since the early days of CBD, Americans have relied on specialty stores like natural food stores and vape shops to supply their favorite hemp products. As of 2021, 29-31% of them still did, with shares of brick-and-mortar CBD sales recovering somewhat from 2020’s lows.

Why do Americans buy CBD at specialty stores?

With around a third of American CBD consumers still buying CBD from their favorite local mom-and-pop shops, it’s clear there’s something about the sales model that’s working. Familiarity with store staff and the benefits of one-on-one product selection assistance outweigh the convenience of buying CBD products online for some consumers, and others simply appreciate the convenience of being able to buy CBD during their normal trips to the store.

The future of US specialty store CBD sales

No matter how successful Ecommerce may become, the local economy isn’t simply going to disappear. Natural food stores, vape stores, smoke shops, boutiques, and other CBD-carrying retailers will continue to exist, and their owners will continue to capitalize on CBD’s enduring popularity. The share of US consumers who buy their CBD in-person, however, is almost sure to drop at least somewhat over the coming years.

3. Chain stores

How many Americans buy CBD at chain stores?

Over the last five years or so, major grocery store chains (most notably Kroger⁶) have given the green light to regional buyers who want to onboard CBD products. Despite corporate America’s attempts to mainstream CBD, however, only 3-5% of CBD consumers choose to buy their hemp products from major consumer packaged goods (CPG) stores.

Why do Americans buy CBD at chain stores?

No matter how much you might love CBD, this cannabinoid isn’t what you’re expecting to see on the shelves of your local conventional grocery store. The slow growth of the share of CBD sales occurring in CPG retail environments is due somewhat to the overall newness of the phenomenon but also to a lack of education among both store employees and customers regarding the benefits of CBD.

American CBD consumers often go to specialty stores in search of particular hemp products, and mainstream CPG retailers — which generally only stock a few CBD SKUs — can’t possibly carry every brand consumers seek. Often turned away by the lack of product variety carried in major chains, this hemp sales channel has yet to truly take flight.

Key takeaways

Let’s summarize all this information in a few bullet points:

- 66% of Americans buy CBD online, 29-31% buy it from specialty stores, and 3-5% buy it from major CPG retailers

- Online CBD sales strengthened during the pandemic and show no signs of slowing down

- Many American CBD users also still buy from their local mom-and-pop shops

- Far fewer have migrated to buying CBD from CPG retailers

- Going forward, online sales are likely to increase at a rapid pace

- CPG CBD sales will also probably grow, but more slowly

- Specialty stores may slowly lose their share of the CBD market due to competition from CPG retailers

How to leverage American CBD buying habits

The obvious answer here is to sell CBD online. Two-thirds of American hemp consumers buy their CBD on the internet, giving you access to the largest share of the US market.

The bar-to-entry for online CBD sales can be high, however. With so many brands now jostling for space, CBD operators have to dance between product differentiation and pricing adjustments to stay distinct and attractive to consumers.

If you want to reach the largest segment of American CBD consumers and thereby set yourself with the most opportunities for profit and success, focusing largely on internet sales is the best approach. Leave yourself open to selling CBD in specialty stores, however, and always be on the lookout for opportunities to enter the nation’s slow-growing consumer packaged goods CBD market.

US retail CBD consumption FAQs

Learn more about CBD consumption in retail stores below:

1. Which major retailers sell CBD?

Some of the major retail chains that now sell CBD products include Walgreens, CVS, Kroger, and Wegmans. Not all retail chains have gotten on the bandwagon, however, with big box stores like Target, Walmart, and Costco notably staying clear.

Even if your ideal store doesn’t carry CBD, chances are that a nearby retailer does. In any case, the type of quality you can get with online CBD usually far outstrips anything you’ll find in a retail store.

2. Is there CBD at Walmart?

No, Walmart does not sell CBD products. There are a few listings on walmart.com that, at first glance, appear to be for products containing CBD.

It only takes a cursory look, however, to recognize that these products do not actually contain any CBD at all. If they did, they would immediately be flagged for removal by Walmart.

3. Are CBD products sold at CVS?

Yes, CVS is one of a number of drug store chains that have adopted the CBD revolution wholeheartedly. You can buy CBD products made by major, recognized brands at almost every CVS location.

Alongside CBD products made by brands that originally started on the internet are anonymous, generic products made by the drug store brand’s existing distributors. If shopping for CBD products at CVS, always go with brands that are also sold online and have a considerable national following.

4. Does Walgreens sell CBD?

Yes, CBD products are widely available at most Walgreens stores nationwide. Almost all the CBD products sold at Walgreens, however, are produced by the drug store company’s in-house manufacturers.

As another option, visit a natural food store for better CBD product quality. Whole Foods is an example of a national food co-op chain that sells CBD, and many local co-ops do as well.

Summary: US CBD sales channels are evolving

The pandemic changed many things — not the least consumer buying behavior. According to the United States Census Bureau⁷, online sales shot up 43% in 2020, exploding from $571.2 billion in 2019 to $815.4 billion in a single year.

And, like many pandemic-inspired changes, this unprecedented shift toward online sales doesn’t seem to be going anywhere anytime soon. Consumers are already buying more products online, so it simply makes sense to buy CBD online now too.

There will never come a point, however, when 100% of CBD sales occur online. As you pivot toward today’s internet-driven CBD economy, never forget to explore potentially lucrative opportunities for diversification offered by brick-and-mortar retail environments.

Sources

- 1. Brenan, B. M. (2021, November 20). 14% of Americans Say They Use CBD Products. Gallup.Com. https://news.gallup.com/poll/263147/americans-say-cbd-products.aspx

- 2. Gelsi, S. (2022, May 4). Legal cannabis sales exceed Starbucks N. America sales in 2021: Report. MarketWatch. https://www.marketwatch.com/story/legal-cannabis-sales-exceed-starbucks-n-america-sales-in-2021-report-2022-05-04

- 3. Drotleff, L. (2022, June 2). Federal cannabis legalization may affect FDA’s approach to CBD regulation, experts say. Hemp Industry Daily. https://hempindustrydaily.com/federal-cannabis-legalization-may-affect-fdas-approach-to-cbd-regulation-experts-say/

- 4. Kopf, D., & Avins, J. (2020, February 23). Survey shows Americans use CBD to treat anxiety and stress. Quartz. https://qz.com/1590765/survey-shows-americans-use-cbd-to-treat-anxiety-and-stress/

- 5. Staff, H. I. D. (2021, March 15). Chart: Top CBD sales channels in 2020. Hemp Industry Daily. https://hempindustrydaily.com/chart-top-cbd-sales-channels/

- 6. LaVito, A., & Hirsch, L. (2019, June 12). Kroger to sell CBD products in nearly 1,000 stores. CNBC. https://www.cnbc.com/2019/06/11/kroger-to-sell-cbd-products-in-nearly-1000-stores.html

- 7. U.S. Census Bureau. (2022, April 26). Annual Retail Trade Survey Shows Impact of Online Shopping on Retail Sales During COVID-19 Pandemic. Census.Gov. https://www.census.gov/library/stories/2022/04/ecommerce-sales-surged-during-pandemic.html