The cannabidiol (CBD) market is poised for phenomenal growth, with projections by Fortune Business Insights suggesting an expansion from USD 11.16 billion in 2024 to an incredible USD 202.45 billion by 2032. This meteoric rise, representing a compound annual growth rate (CAGR) of 43.66%, reflects shifting consumer attitudes, regulatory reforms, and innovative product developments. But what’s driving this market transformation, and what can we expect in the coming years? Let’s explore.

Key Drivers of CBD Market Growth

1. Evolving Legal Frameworks

The relaxation of cannabis-related laws worldwide has been a cornerstone of the CBD market’s growth. In the U.S., the 2018 Farm Bill legalized hemp-derived CBD, marking a turning point for the industry. As of 2023, North America accounted for 47.04% of the global market share, with the U.S. market expected to reach approximately USD 78.74 billion by 2032.

Other regions, such as Canada, Mexico, and parts of Europe, have also adopted more progressive cannabis policies, fostering an environment conducive to market expansion. Countries like Germany are embracing CBD for personal use and pharmaceutical and therapeutic applications.

2. Rising Health and Wellness Awareness

Consumers today are more focused on holistic health and natural remedies than ever before. CBD is widely celebrated for its therapeutic potential, offering benefits for anxiety relief, chronic pain, seizure management, and even skincare. These properties have made CBD a go-to ingredient in pharmaceuticals, cosmetics, food and beverages, and pet care products.

Notable examples include:

– Epidiolex, an FDA-approved CBD medication, used for treating epilepsy.

– CBD-infused wellness drinks like those offered by Trip, a UK-based company.

3. Product Innovation and Diversification

Manufacturers are continually introducing new CBD products to meet diverse consumer preferences. The variety is vast, from tinctures and capsules to edibles and skincare products. British Cannabis, for example, expanded its portfolio through the acquisition of Goodbody Botanicals Ltd in 2024, signaling an aggressive push towards market leadership.

Emerging cannabinoids are also playing a major role—learn more in our detailed guide to CBN, CBG, CBC, and CBT.

Market Segmentation: A Diverse Ecosystem

1. By Source

– Hemp-Derived CBD: Dominates due to its low THC content, making it more accessible under global laws.

– Marijuana-Derived CBD: Gaining traction in regions with more relaxed cannabis policies.

2. By Application

– Pharmaceuticals: Used in FDA-approved treatments like Epidiolex.

– Food & Beverages: Gummies, candies, and CBD-infused drinks are a growing trend.

– Cosmetics: Popular for anti-inflammatory and anti-aging properties.

– Pet Care: Addresses anxiety, inflammation, and joint health in animals.

COVID-19’s Impact on the CBD Market

The pandemic brought both challenges and opportunities to the CBD industry. Initially, lockdowns disrupted supply chains and dampened in-store sales. The International Facility Management Association (IFMA) reported that 84% of brick-and-mortar retail operations faced severe disruptions in 2020. However, the demand for CBD products surged as consumers turned to online shopping. Stress, anxiety, and sleep issues—common during the pandemic—further accelerated sales through direct-to-consumer (DTC) channels.

Regional Insights: A Global View

North America

North America continues to dominate the global CBD market, accounting for nearly half of the industry’s total share in 2023.

Progressive legislation, consumer education, and strong infrastructure enable large-scale production and distribution of CBD products. The United States leads the CBD market in North America, with Canada contributing significantly and Mexico showing great potential.

The Role of Favorable Legislation

The 2018 Farm Bill marked a turning point for the U.S. CBD industry, legalizing hemp cultivation and its derivatives federally. This legislation opened the doors for widespread innovation and commercialization of CBD products, driving growth across sectors. Additionally, individual states, such as California, Colorado, and Oregon, have implemented cannabis-friendly policies, creating a fertile environment for market expansion.

Canada, which legalized cannabis entirely in 2018, has also significantly contributed to the region’s leadership in the CBD market. With a fully regulated cannabis industry, Canadian businesses benefit from clear guidelines that allow for the development of high-quality products. Mexico is nearing regulatory reform, with cannabis legalization expected to strengthen North America’s leadership in the global CBD market.

Key Sectors Driving Market Growth

North America’s CBD market thrives across various sectors, each catering to different consumer needs and preferences. Here’s a closer look:

Edibles

The edibles category has emerged as one of the most lucrative segments of the CBD market. CBD-infused gummies, chocolates, and beverages are popular for their convenience and discretion, making them ideal for everyday use. Brands like Charlotte’s Web and Green Roads have been at the forefront, offering a wide range of flavors and dosages to cater to diverse consumer preferences.

CBD-infused beverages are gaining momentum, with products like sparkling waters, teas, and functional drinks becoming staples in the wellness community. Companies such as Recess and Trip have successfully captured the market’s interest by blending CBD with adaptogens, vitamins, and other health-boosting ingredients.

Skincare

CBD is a rising star in the skincare industry thanks to its anti-inflammatory, antioxidant, and soothing properties. CBD-enriched creams, oils, and serums are gaining popularity, especially among affluent consumers seeking natural and effective skincare products.

Products targeting issues such as acne, eczema, and signs of aging have garnered significant attention. Brands like Kiehl’s and Lord Jones have developed premium CBD skincare lines, elevating the segment to a luxury status. Demand for CBD-infused sunscreens, lip balms, and moisturizers is growing, fueled by consumer interest in versatile, multitasking products.

Pet Care

The pet care industry increasingly uses CBD as a natural solution for anxiety, arthritis, and appetite issues in animals. This segment has witnessed exponential growth as pet owners seek holistic solutions to enhance their furry companions’ well-being.

CBD-infused pet products, including oils, treats, and capsules, have become increasingly popular. Companies like Honest Paws and HolistaPet are leading the charge, offering products tailored to dogs, cats, and even horses. These products often target specific concerns, such as calming hyperactive pets or improving mobility in aging animals.

The E-Commerce Advantage

E-commerce has played a vital role in bolstering North America’s CBD market. Online platforms allow brands to bypass traditional retail hurdles and reach consumers directly. This shift was particularly significant during the COVID-19 pandemic when lockdowns forced many consumers to shop online. Direct-to-consumer (DTC) channels have not only boosted sales but also provided companies with valuable consumer data, enabling them to refine their offerings and marketing strategies.

Europe

Europe has emerged as a promising market for cannabidiol (CBD) products, with countries like Germany, Italy, and Greece leading the way. The European industrial hemp market, which supplies essential raw materials for CBD products, accounted for 31.01% of the global share in 2023.

This significant market share reflects the region’s emphasis on safety and quality, which has earned consumer trust and boosted demand for CBD oils, capsules, and cosmetics.

Germany, in particular, is establishing itself as a leader in the European hemp market, with bright development prospects as sustainability gains prominence. The country’s focus on sustainable practices and high-quality production standards has positioned it at the forefront of the CBD industry in Europe.

Italy and Greece are also contributing to the market’s growth. However, Italy plans to restrict its nascent ‘cannabis light’ industry, which could impact the availability and development of CBD products in the country (source: Reuters).

Overall, Europe’s commitment to stringent safety and quality standards has fostered consumer confidence, leading to increased demand for CBD products across the region.

Asia-Pacific

Asia-Pacific is quickly becoming a key player in the global CBD market, fueled by interest in natural skincare and regulatory changes. In 2023, the Asia-Pacific CBD market was valued at approximately USD 440.5 million and is projected to grow at a compound annual growth rate (CAGR) of 24.1% from 2024 to 2030.

Market Drivers

Rising Demand for Natural Skincare Products

Consumers in countries like India are increasingly seeking natural and sustainable personal care solutions. This trend is exemplified by Beardo, a leading men’s lifestyle brand in India, which launched a hemp-based personal care range in November 2021. This product line caters to the growing demand for eco-friendly skincare options.

Evolving Regulatory Frameworks

The legal status of CBD varies across the Asia-Pacific region, influencing market dynamics. For instance, Japan has proposed stringent regulations limiting THC levels in CBD products to 0.001% for oils, which could significantly impact the market. These changes to the Cannabis Control Act aim to tighten recreational cannabis rules while legalizing cannabis-based medicines and regulating CBD products.

Challenges

Regulatory Hurdles

Strict regulations in countries like Japan pose challenges for market expansion. The proposed THC limit is considered unrealistic by industry stakeholders, potentially leading to the closure of many CBD businesses in Japan.

Opportunities

Market Potential in India

The successful launch of hemp-based personal care products by brands like Beardo indicates a growing acceptance and potential for CBD-infused products in India. This trend suggests opportunities for further market penetration and product diversification.

The Asia-Pacific CBD market is on a growth trajectory, propelled by consumer demand for natural products and gradual regulatory acceptance. However, navigating the complex regulatory environment remains crucial for sustained growth and market entry.

Challenges and Opportunities

Regulatory Challenges and Uncertainties in the CBD Market

Despite its growth potential, the CBD market faces significant regulatory challenges, posing obstacles for companies entering or expanding in the industry. The lack of uniform global regulations and evolving legal frameworks create a landscape fraught with complexity and uncertainty. This challenge affects product development and market entry strategies, making regulatory navigation essential for businesses in the CBD industry.

Global Variability in CBD Regulations

One of the primary challenges is the patchwork of regulations across different regions. In the U.S., the 2018 Farm Bill legalized hemp-derived CBD, but the FDA still lacks clear guidelines for its use in consumables. This regulatory ambiguity has created hesitancy among some companies, delaying product launches and innovation.

In Europe, the situation is slightly more structured, but still inconsistent. The EU permits hemp-derived CBD with less than 0.2% THC, but stricter rules in France and Germany create market access disparities. Similarly, in Asia-Pacific, countries like Japan enforce stringent THC limits, making it difficult for businesses to comply with both domestic and export requirements. India, on the other hand, shows promise with its growing acceptance of hemp-based products, though comprehensive CBD-specific legislation remains absent.

Impact on Product Development and Market Expansion

These regulatory uncertainties directly affect the industry’s ability to innovate and scale. Companies often face delays in approvals, inconsistent labeling requirements, and challenges in determining allowable THC thresholds. The FDA’s ongoing review of CBD’s safety for ingestibles has stalled U.S. businesses, limiting confident marketing of CBD edibles and beverages. Internationally, unclear guidelines obstruct cross-border trade and supply chain operations, deterring investment in legally uncertain regions.

The Need for Harmonized Standards

For the CBD market to realize its full potential, harmonized global standards are essential. Regulatory clarity would boost investor confidence and encourage innovation and competition. To succeed, businesses must invest in legal expertise, collaborate with policymakers, and address compliance challenges proactively. Tackling regulatory hurdles ensures sustainable growth while upholding safety and quality standards in the evolving CBD industry.

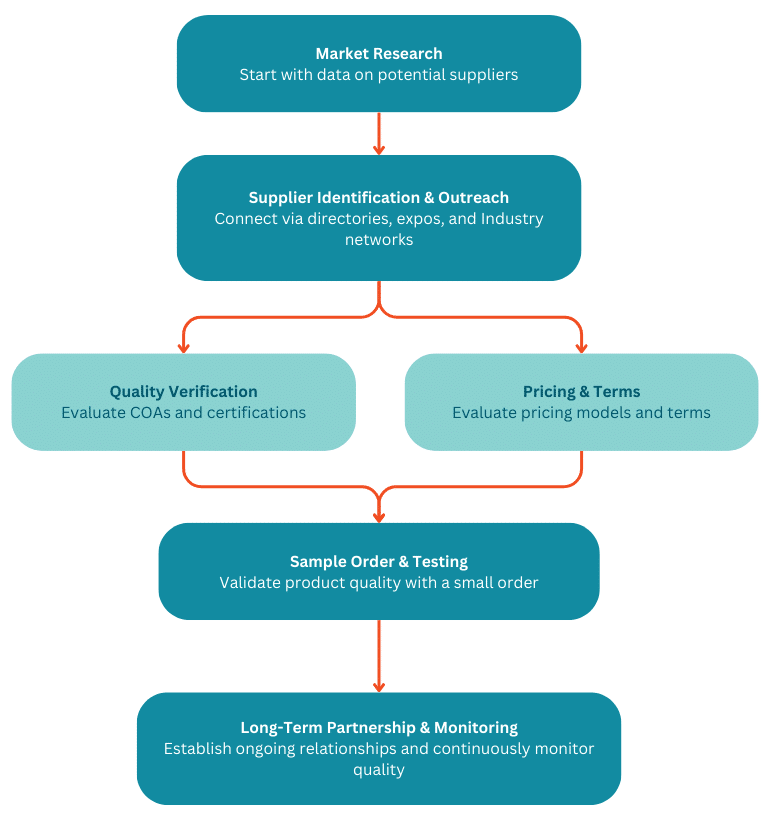

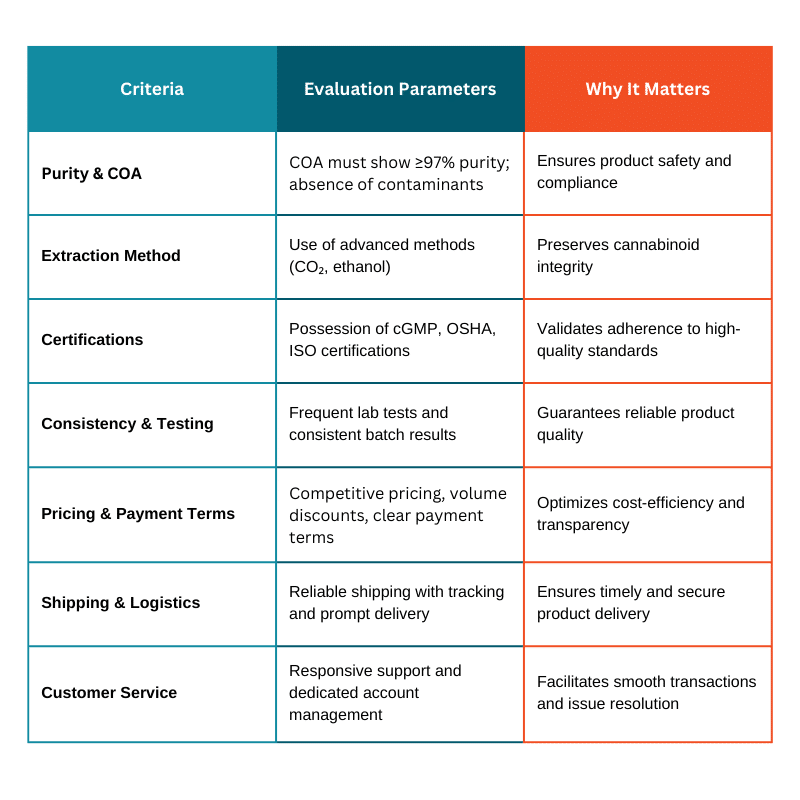

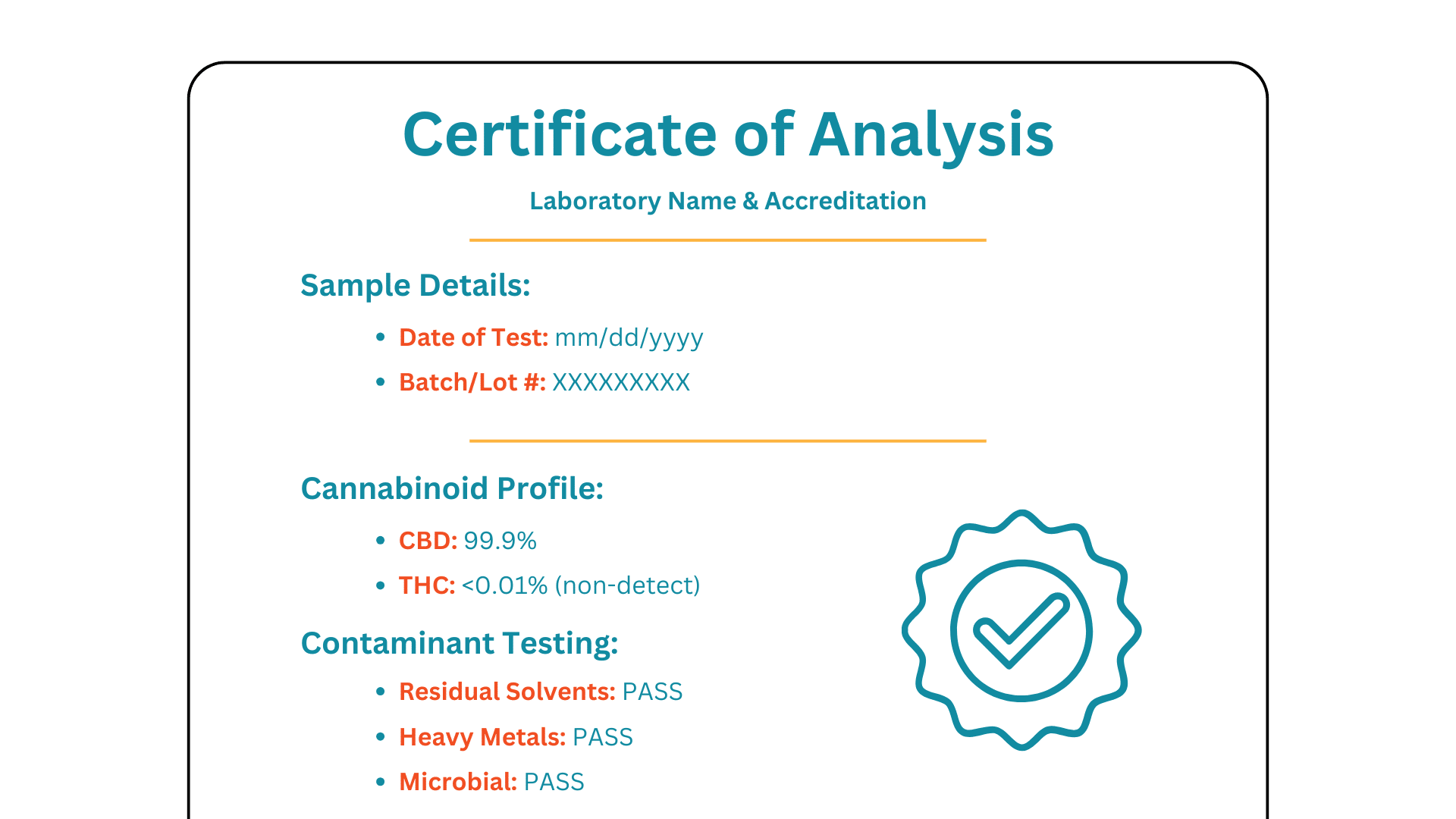

Quality Control and Product Safety Challenges in the CBD Industry

Ensuring consistent quality and safety of cannabidiol (CBD) products remains a critical challenge for the industry. As the market expands and competition intensifies, working with a supplier that maintains high standards is essential for fostering consumer trust, adhering to regulatory requirements, and supporting sustainable growth. However, the lack of standardized practices across regions and companies introduces significant risks that can hinder the industry’s potential.

Inconsistent Quality Standards

One of the most pressing issues is the variability in product quality due to differences in sourcing, extraction methods, and manufacturing practices. Many CBD products on the market fail to meet label claims, either containing inaccurate CBD concentrations or, in some cases, harmful contaminants like pesticides, heavy metals, and residual solvents. A 2021 study revealed that over 50% of tested CBD products were mislabeled, highlighting the urgent need for stricter quality control measures.

This inconsistency not only affects product efficacy but also undermines consumer confidence. Without clear and enforceable quality standards, the risk of subpar or unsafe products entering the market remains high, deterring new consumers and tarnishing the reputation of the broader CBD industry.

Challenges in Safety Assurance

Ensuring product safety is another critical hurdle. The absence of universally accepted guidelines for permissible THC levels, contaminants, and dosing recommendations creates a fragmented regulatory environment. For example, while the United States allows up to 0.3% THC in hemp-derived products, Europe caps THC content at 0.2%, and some countries in Asia enforce limits as low as 0.001%. These discrepancies complicate compliance for companies operating across borders.

Additionally, the lack of long-term safety data for CBD use—especially in ingestible and high-concentration products—raises concerns. Consumers often rely on anecdotal evidence, which can lead to misuse or unrealistic expectations. The Food and Drug Administration (FDA) has repeatedly highlighted the need for rigorous testing and data to establish CBD’s safety profile, particularly for vulnerable populations such as pregnant women and children.

The Path Forward: Industry Solutions

To address these challenges, the CBD industry must prioritize the implementation of Good Manufacturing Practices (GMP) and third-party testing to ensure product quality and safety. Transparency in sourcing, manufacturing, and labeling is crucial for building consumer trust. Initiatives like QR codes on packaging, which link to lab results and certifications, are becoming increasingly common and can serve as a model for the industry.

Collaborations with regulatory bodies, scientists, and advocacy groups can also help establish standardized testing protocols and guidelines. By investing in quality assurance measures and embracing stricter oversight, companies can not only comply with regulations but also position themselves as trusted leaders in the CBD market.

The challenges of quality control and product safety are significant, but they also present an opportunity for the CBD industry to differentiate itself through transparency, accountability, and innovation. By addressing these issues head-on, businesses can build a foundation of trust, paving the way for long-term market growth and consumer confidence.

Addressing Consumer Misconceptions and Lack of Awareness About CBD

Despite CBD’s rising popularity, consumer misconceptions and limited awareness remain major barriers, hindering product acceptance and slowing market growth. Misinformation about CBD’s uses and safety fuels skepticism, restricting the industry’s ability to realize its full potential.

Common Misconceptions About CBD

One of the most pervasive misconceptions about CBD is its association with tetrahydrocannabinol (THC), the psychoactive compound in cannabis. Many consumers erroneously believe that CBD causes a “high,” leading to hesitation in trying products derived from cannabis or hemp. This confusion largely arises from limited understanding of the extraction process, which isolates CBD and minimizes or eliminates THC in the final product.

Other misconceptions include:

– Unrealistic Expectations: Consumers often expect CBD to be a cure-all for a wide range of ailments, from chronic pain to severe anxiety, based on anecdotal claims. When these expectations are unmet, dissatisfaction and mistrust can follow.

– Safety Concerns: Some consumers worry about the potential for addiction or adverse effects, despite research indicating that CBD is generally safe and non-addictive

The Role of Education in Dispelling Misinformation

Bridging the knowledge gap is critical for increasing consumer confidence and adoption of CBD products. Companies and industry stakeholders must invest in education campaigns to clarify the science behind CBD and its benefits. For example:

– Highlighting Scientific Evidence: Sharing peer-reviewed studies and clinical trial results can reinforce CBD’s therapeutic potential while addressing safety concerns. For instance, CBD’s effectiveness in managing epilepsy has been well-documented, with the FDA-approved medication Epidiolex serving as a prime example.

– Transparency in Labeling: Providing clear and accurate information on product labels, such as CBD concentration, THC content, and sourcing details, helps demystify the product and instill confidence.

Impact of Awareness on Market Expansion

Consumer awareness is directly linked to market growth. In regions where CBD education is limited, market penetration remains slow. Conversely, markets like North America, where information campaigns have been more robust, show higher adoption rates and broader product acceptance. Educating consumers in emerging markets like Asia-Pacific and Latin America can reduce stigma, encourage trials, and accelerate CBD market growth.

Overcoming misconceptions and educating consumers about CBD is essential for breaking down barriers to market acceptance and expansion. Prioritizing transparency and educational initiatives enables companies to build consumer trust, drive informed decisions, and unlock CBD industry potential.

Opportunities to Capitalize on the CBD Market Growth

R&D Investments: Exploring CBD’s therapeutic potential in areas such as cardiovascular health, neuroprotection, and oncology is opening new avenues for market growth. Studies indicate that CBD may offer neuroprotective benefits by activating receptors like CB2 and TRPV-1, which are expressed in dopaminergic neurons. Additionally, research suggests that CBD’s anti-inflammatory and antioxidant properties could be beneficial in treating cardiovascular diseases. In oncology, CBD is being investigated for its potential to alleviate cancer-related symptoms and enhance the efficacy of certain treatments.

Collaborations: Partnerships between pharmaceutical giants and CBD-focused companies are accelerating product innovation and market entry. Notable examples include:

– Novartis and Tilray: Collaborated to develop and distribute medical cannabis products globally.

– Jazz Pharmaceuticals’ Acquisition of GW Pharmaceuticals: In 2021, Jazz Pharmaceuticals acquired GW Pharmaceuticals, the manufacturer of Epidiolex, a CBD-based treatment for epilepsy, in a landmark $7.2 billion deal.

– DSM and Brains Bioceutical: Entered into an exclusive global partnership to explore the therapeutic potential of cannabinoids in early-stage drug development.

These collaborations leverage combined expertise to advance CBD-based therapeutics and expand market reach.

Expansion into Emerging Markets: Regions such as Asia-Pacific and Latin America present untapped potential for CBD market growth. In Asia-Pacific, increasing consumer interest in natural products and evolving regulatory landscapes are creating new opportunities. For instance, India’s Beardo launched a hemp-based personal care range, indicating growing acceptance. However, regulatory challenges, such as Japan’s stringent THC limits, pose hurdles. In Latin America, countries like Brazil are witnessing a surge in medical cannabis use, with regulatory frameworks gradually becoming more accommodating. Strategic entry into these markets requires navigating complex legal environments and understanding local consumer behaviors.

Seizing these opportunities allows companies to lead the evolving CBD industry, fostering innovation and meeting increasing global demand.

Future Outlook: The Road to 2032

The CBD market growth rate is projected to surpass USD 202.45 billion by 2032, driven by innovation, regulatory reforms, and growing consumer acceptance. Companies investing in research, education, and product diversification are poised to thrive.

Key Takeaways

– North America will continue to lead, but Europe and Asia-Pacific are catching up.

– Product quality and consumer education are vital for sustained growth.

– Strategic partnerships and new applications will define the next wave of CBD market evolution.

Conclusion

The cannabidiol (CBD) market exemplifies how evolving consumer preferences, groundbreaking innovation, and regulatory shifts can revolutionize an industry. Once a niche market, CBD has become a global force, touching diverse sectors such as healthcare, wellness, cosmetics, and even pet care. Its meteoric growth—projected to exceed USD 202.45 billion by 2032—reflects a broader cultural shift toward natural, plant-based remedies and holistic health solutions. The market’s trajectory underscores not only the vast potential of CBD but also the importance of fostering consumer trust through education, transparency, and quality assurance.

As the CBD industry evolves, businesses that tackle regulatory complexities, pursue advanced research, and prioritize consumer needs will lead this dynamic market. With North America’s innovation, Europe’s focus on quality, and Asia-Pacific’s untapped potential, opportunities for growth and diversification abound. Companies that adapt and invest strategically will secure a strong position and achieve significant success in the coming years.